Multiple Choice

Use the information below to answer the following question.

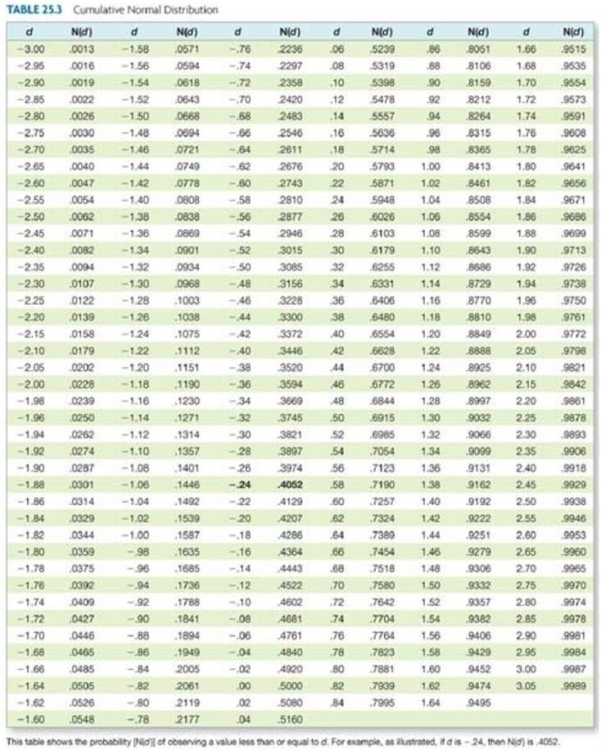

You own a lot in Key West, Florida, that you are considering selling. Similar lots have recently sold for $1.2 million. Over the past five years, the price of land in the area has varied with a standard deviation of 19 percent. A potential buyer wants an option to buy the land in the next 9 months for $1,310,000. The risk-free rate of interest is 7 percent per year, compounded continuously. How much should you charge for the option? Round your answer to the nearest $100.

A) $62,000

B) $68,900

C) $63,700

D) $62,500

E) $60,400

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Webster United stock is priced at $35.79

Q7: The delta of a call option on

Q8: According to put-call parity, the present value

Q9: The current market value of the assets

Q10: The implied standard deviation used in the

Q12: This morning, Kate put a European protective

Q13: Which one of the following statements related

Q14: A call option with an exercise price

Q15: A stock is selling for $62 per

Q16: Use the information below to answer the