Multiple Choice

Use the information below to answer the following question.

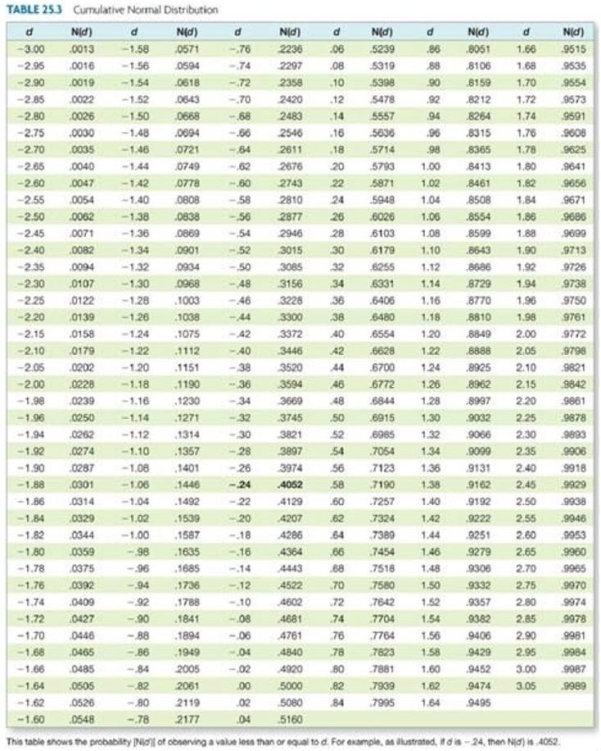

Alpha is considering a purely financial merger with Beta. Alpha currently has a market value of $14 million, an asset return standard deviation of 55 percent, and pure discount debt of $6 million that matures in four years. Beta has a market value of $6 million, an asset return standard deviation of 60 percent, and pure discount debt of $2 million that matures in four years. The risk free rate, continuously compounded, is 3.5 percent. The combined equity value of the two separate firms is $14,180,806. By what amount will the combined equity value change if the merger occurs and the asset return standard deviation of the merged firm is 45 percent?

A) −$548,285

B) −$314,007

C) $0

D) $99,087

E) $286,403

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Use the information below to answer the

Q12: This morning, Kate put a European protective

Q13: Which one of the following statements related

Q14: A call option with an exercise price

Q15: A stock is selling for $62 per

Q17: The estimate of the future volatility of

Q18: A decrease in which of the following

Q19: When computing the value of a call

Q20: A stock is currently selling for $39

Q21: Use the information below to answer the