Multiple Choice

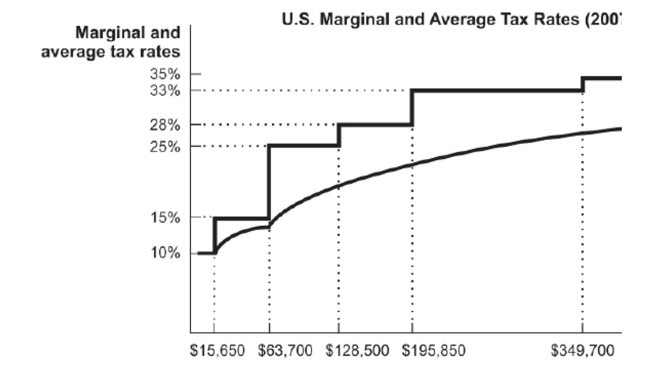

Figure: U.S. Marginal and Average Tax Rates  Reference: Ref 17-1 (Figure: U.S. Marginal and Average Tax Rates) According to the figure, an individual who earns $150,000 a year has an approximate average tax rate of

Reference: Ref 17-1 (Figure: U.S. Marginal and Average Tax Rates) According to the figure, an individual who earns $150,000 a year has an approximate average tax rate of

A) 28 percent.

B) 25 percent.

C) 21 percent.

D) 15 percent.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: (Table: Changes in the National Debt) (This

Q5: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3375/.jpg" alt=" In this table,

Q6: Suppose the tax rate on the first

Q8: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3375/.jpg" alt=" Reference: Ref 17-1

Q9: Taxpayers in the United States for the

Q10: This table shows data on taxes paid

Q42: Social Security benefits have become less generous

Q75: Since 1960,marginal tax rates in the United

Q165: The legislation Congress passed in 1969 to

Q267: Workers bear at least a majority, if