Multiple Choice

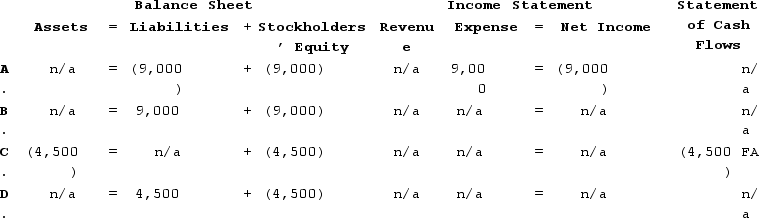

On March 1, Year 1, Gilmore Incorporated declared a cash dividend on its 1,500 outstanding shares of $50 par value, 6% preferred stock. The dividend will be paid on May 1, Year 1 to the stockholders of record as of April 1, Year 1.How will the entry to record the dividend on March 1 affect the financial statements?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Correct Answer:

Verified

Correct Answer:

Verified

Q8: What is the meaning of "par value"

Q22: Which of the following terms designates the

Q46: Blair Scott started a sole proprietorship by

Q86: The term "Retained Earnings" is best explained

Q87: At the end of the accounting period,

Q88: A sole proprietorship was established on January

Q92: Which of the following is not normally

Q95: When a corporation records a stock dividend,

Q96: Indicate how each event affects the horizontal

Q125: A benefit of corporations is that they