Essay

A sole proprietorship was established on January 1, Year 1, when it received $30,000 cash from Connor Howard, the owner. During Year 1, the business earned $80,000 in cash revenues and paid $62,000 in cash expenses. Howard withdrew $9,000 from the business during Year 1.

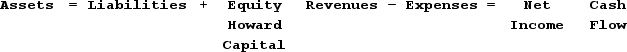

Required:Indicate how each of the transactions and events for the Howard sole proprietorship affects the financial statements model, below. Indicate dollar amounts of increases and decreases. For cash flows, indicate whether each is an operating activity (OA), investing activity (IA), or financing activity (FA). Indicate NA if an element is not affected by a transaction.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: What is the meaning of "par value"

Q46: Blair Scott started a sole proprietorship by

Q76: Lack of ease in transferability of ownership

Q83: Indicate how each event affects the horizontal

Q84: When the common stock account is disclosed

Q86: The term "Retained Earnings" is best explained

Q87: At the end of the accounting period,

Q91: On March 1, Year 1, Gilmore Incorporated

Q92: Which of the following is not normally

Q125: A benefit of corporations is that they