Essay

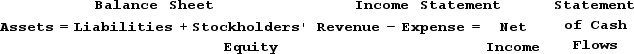

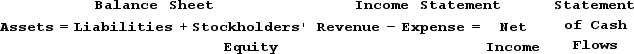

On June 14, Year 1, Sure-Fit Shoe Store sold $12,000 of merchandise that cost $8,000 and accepted credit cards as payment. Sure-Fit electronically transmitted the credit card forms to the credit card company which charges a 3% fee to handle such transactions. On June 18, Year 1, Sure-Fit received the proceeds from the credit card company.How will the entry to record the sale of the merchandise on June 14, Year 1, affect the company's financial statements?

How will the entry to record the credit card proceeds on June 18, Year 1, affect the company's financial statements?

How will the entry to record the credit card proceeds on June 18, Year 1, affect the company's financial statements?

Correct Answer:

Verified

a.

b.

b.

A receivable is recorded for ...

A receivable is recorded for ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q29: Indicate how each event affects the horizontal

Q30: Green Acres Lawn Care provided $600,000 of

Q31: Kona Espresso Machine Company provides services on

Q32: The following transactions apply to Sam's

Q33: Define the terms FIFO and LIFO and

Q35: Max Company's first year in operation

Q36: Indicate how each event affects the horizontal

Q38: Jones Company sells exercise bikes. Its beginning

Q39: Indicate how each event affects the horizontal

Q59: In an inflationary period,which inventory cost flow