Essay

Jones Company sells exercise bikes. Its beginning inventory was 100 units at $200 per unit. During the year, Jones made two purchases of the bikes: first, a 300-unit purchase at $220 per unit, and then 200 units at $250 per unit. The ending inventory for the year was 250 units.

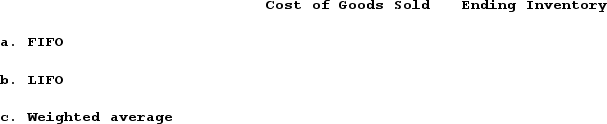

Required:Determine the amount of product costs that would be allocated to cost of goods sold and ending inventory, assuming that Jones uses each of the following methods. (Round intermediate calculations to 2 decimal places. Round final answers to whole dollars.)FIFOLIFOWeighted average

Correct Answer:

Verified

Weighted average c...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Weighted average c...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: After the accounts are adjusted at the

Q33: Define the terms FIFO and LIFO and

Q34: On June 14, Year 1, Sure-Fit Shoe

Q35: Max Company's first year in operation

Q36: Indicate how each event affects the horizontal

Q39: Indicate how each event affects the horizontal

Q40: Indicate how each event affects the horizontal

Q41: In the first year of operations, John's

Q46: If Bowman Company is using FIFO,how would

Q59: In an inflationary period,which inventory cost flow