Multiple Choice

TABLE 13-7

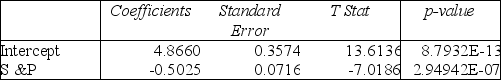

An investment specialist claims that if one holds a portfolio that moves in the opposite direction to the market index like the S&P 500, then it is possible to reduce the variability of the portfolio's return. In other words, one can create a portfolio with positive returns but less exposure to risk.

A sample of 26 years of S&P 500 index and a portfolio consisting of stocks of private prisons, which are believed to be negatively related to the S&P 500 index, is collected. A regression analysis was performed by regressing the returns of the prison stocks portfolio (Y) on the returns of S&P 500 index (X) to prove that the prison stocks portfolio is negatively related to the S&P 500 index at a 5% level of significance. The results are given in the following Excel output.

Note: 2.94942E-07 = 2.94942*10⁻⁷

-Referring to Table 13-7, to test whether the prison stocks portfolio is negatively related to the S&P 500 index, the appropriate null and alternative hypotheses are, respectively,

A) H₀: ρ ≥ 0 vs. H₁: ρ < 0.

B) H₀: ρ ≤ 0 vs. H₁: ρ > 0.

C) H₀: r ≥ 0 vs. H₁: r < 0.

D) H₀: r ≤ 0 vs. H₁: r > 0.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: TABLE 13-4<br>The managers of a brokerage firm

Q3: TABLE 13-4<br>The managers of a brokerage firm

Q4: TABLE 13-13<br>In this era of tough economic

Q6: TABLE 13-8<br>It is believed that GPA (grade

Q8: TABLE 13-2<br>A candy bar manufacturer is interested

Q9: Referring to Table 13-2, what is <img

Q10: TABLE 13-13<br>In this era of tough economic

Q11: TABLE 13-4<br>The managers of a brokerage firm

Q101: The Regression Sum of Squares (SSR)can never

Q198: The width of the prediction interval for