Multiple Choice

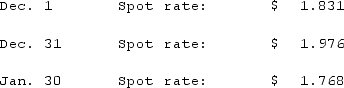

Clark Co., a U.S. corporation, sold inventory on December 1, 2021, with payment of 12,000 British pounds to be received in sixty days. The pertinent exchange rates were as follows:  What amount of foreign exchange gain or loss should be recorded on December 31?

What amount of foreign exchange gain or loss should be recorded on December 31?

A) $756 gain.

B) $756 loss.

C) $0.

D) $1,740 loss.

E) $1,740 gain.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: All of the following data may be

Q12: A U.S. company buys merchandise from a

Q38: U.S. GAAP provides guidance for hedges of

Q40: Lawrence Company, a U.S. company, ordered parts

Q98: Clark Co., a U.S. corporation, sold inventory

Q100: A U.S. company buys merchandise from a

Q101: On March 1, 2021, Mattie Company received

Q102: On December 1, 2021, Keenan Company, a

Q103: On October 1, 2021, Eagle Company forecasts

Q105: Potter Corp. (a U.S. company in Colorado)had