Multiple Choice

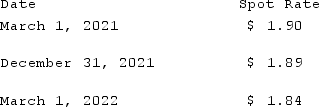

On March 1, 2021, Mattie Company received an order to sell a machine to a customer in England at a price of 200,000 British pounds. The machine was shipped and payment was received on March 1, 2022. On March 1, 2021, Mattie purchased a put option giving it the right to sell 200,000 British pounds on March 1, 2022 at a price of $380,000. Mattie properly designates the option as a fair hedge of the pound firm commitment. The option cost $2,000 and had a fair value of $2,200 on December 31, 2021. The following spot exchange rates apply:  Mattie's incremental borrowing rate is 12%, and the present value factor for two months at a 12% annual rate is 0.9803.What was the net increase or decrease in cash flow from having purchased the foreign currency option to hedge this exposure to foreign exchange risk?

Mattie's incremental borrowing rate is 12%, and the present value factor for two months at a 12% annual rate is 0.9803.What was the net increase or decrease in cash flow from having purchased the foreign currency option to hedge this exposure to foreign exchange risk?

A) $0

B) $10,000 increase.

C) $10,000 decrease.

D) $20,000 increase.

E) $20,000 decrease.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: All of the following data may be

Q12: A U.S. company buys merchandise from a

Q38: U.S. GAAP provides guidance for hedges of

Q96: Coyote Corp. (a U.S. company in Texas)had

Q98: Clark Co., a U.S. corporation, sold inventory

Q100: A U.S. company buys merchandise from a

Q102: On December 1, 2021, Keenan Company, a

Q103: On October 1, 2021, Eagle Company forecasts

Q104: Clark Co., a U.S. corporation, sold inventory

Q105: Potter Corp. (a U.S. company in Colorado)had