Multiple Choice

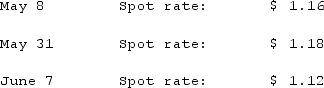

Clark Stone purchases raw material from its foreign supplier, Rinne Clay, on May 8. Payment of 1,500,000 foreign currency units (FC) is due in 30 days. May 31 is Clark's fiscal year-end. The pertinent exchange rates were as follows:  For what amount should Clark's Accounts Payable be credited on May 8?

For what amount should Clark's Accounts Payable be credited on May 8?

A) $1,740,000.

B) $1,850,000.

C) $1,500,000.

D) $1,680,000.

E) $1,770,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q18: Nelson Co. ordered parts costing §120,000 from

Q25: What are the two separate transactions that

Q53: Atherton, Inc., a U.S. company, expects to

Q55: Jackson Corp. (a U.S.-based company)sold parts to

Q57: On October 1, 2021, Eagle Company forecasts

Q62: Potter Corp. (a U.S. company in Colorado)had

Q63: Potter Corp. (a U.S. company in Colorado)had

Q80: What happens when a U.S. company sells

Q90: How does a foreign currency forward contract

Q95: Primo Inc., a U.S. company, ordered parts