Multiple Choice

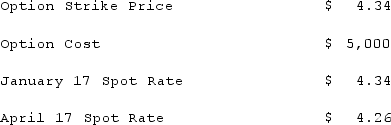

Atherton, Inc., a U.S. company, expects to order goods from a foreign supplier at a price of 100,000 lira, with delivery and payment to be made on April 17. On January 17, Atherton purchased a three-month call option on 100,000 lira and designated this option as a cash flow hedge of a forecasted foreign currency transaction. The following exchange rates apply:  What amount will Atherton include as an option expense in net income for the period January 17 to April 17?

What amount will Atherton include as an option expense in net income for the period January 17 to April 17?

A) $4,000

B) $4,260

C) $4,340

D) $5,000

E) $5,260

Correct Answer:

Verified

Correct Answer:

Verified

Q25: What are the two separate transactions that

Q48: Clark Stone purchases raw material from its

Q49: Coyote Corp. (a U.S. company in Texas)had

Q50: Jackson Corp. (a U.S.-based company)sold parts to

Q51: Jackson Corp. (a U.S.-based company)sold parts to

Q55: On April 1, Quality Corporation, a U.S.

Q55: Jackson Corp. (a U.S.-based company)sold parts to

Q57: On October 1, 2021, Eagle Company forecasts

Q58: Clark Stone purchases raw material from its

Q95: Primo Inc., a U.S. company, ordered parts