Multiple Choice

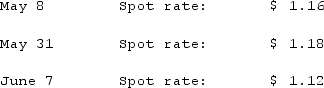

Clark Stone purchases raw material from its foreign supplier, Rinne Clay, on May 8. Payment of 1,500,000 foreign currency units (FC) is due in 30 days. May 31 is Clark's fiscal year-end. The pertinent exchange rates were as follows:  How much Foreign Exchange Gain or Loss should Clark record on May 31?

How much Foreign Exchange Gain or Loss should Clark record on May 31?

A) $0.

B) $30,000 gain.

C) $30,000 loss.

D) $60,000 gain.

E) $60,000 loss.

Correct Answer:

Verified

Correct Answer:

Verified

Q39: All of the following hedges are used

Q43: On October 1, 2021, Eagle Company forecasts

Q44: Coyote Corp. (a U.S. company in Texas)had

Q47: On October 1, 2021, Eagle Company forecasts

Q49: Coyote Corp. (a U.S. company in Texas)had

Q50: Jackson Corp. (a U.S.-based company)sold parts to

Q51: Jackson Corp. (a U.S.-based company)sold parts to

Q53: Atherton, Inc., a U.S. company, expects to

Q55: On April 1, Quality Corporation, a U.S.

Q73: Schrute Inc. had a receivable from a