Multiple Choice

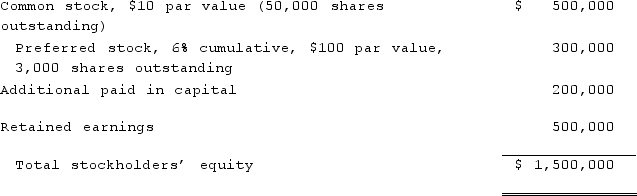

On January 1, 2021, Nichols Company acquired 80% of Smith Company's common stock and 40% of its non-voting, cumulative preferred stock. The consideration transferred by Nichols was $1,200,000 for the common and $124,000 for the preferred. There was no premium in the value of consideration transferred. Any excess acquisition-date fair value over book value is considered goodwill. The capital structure of Smith immediately prior to the acquisition is:  With respect to Nichols' investment in Smith, determine the amount to be recorded and identify which account should be adjusted to reflect such amount.

With respect to Nichols' investment in Smith, determine the amount to be recorded and identify which account should be adjusted to reflect such amount.

A) $1,324,000 for Investment in Smith.

B) $1,200,000 for Investment in Smith.

C) $1,200,000 for Investment in Smith's Common Stock and $124,000 for Investment in Smith's Preferred Stock.

D) $1,200,000 for Investment in Smith's Common Stock and $120,000 for Investment in Smith's Preferred Stock.

E) $1,448,000 for Investment in Smith's Common Stock.

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Johnson, Inc. owns control over Kaspar, Inc.

Q49: Webb Company purchased 90% of Jones Company

Q76: Webb Company purchased 90% of Jones Company

Q91: On January 1, 2021, Nichols Company acquired

Q92: Panton, Inc. acquired 18,000 shares of Glotfelty

Q93: Thomas Inc. had the following stockholders' equity

Q94: The balance sheets of Butler, Inc. and

Q97: On January 1, 2021, Bast Co. had

Q99: On January 1, 2021, A. Hamilton, Inc.

Q104: Knight Co. owned 80% of the common