Multiple Choice

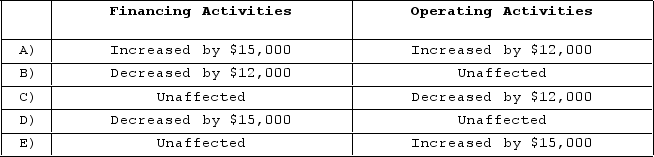

Dayton, Inc. owns 80% of Haber Corp. The consolidated income statement for a year reports $60,000 Noncontrolling Interest in Haber Corp.'s Net Income. Haber paid dividends in the amount of $75,000 for the year. What are the effects of these transactions in the consolidated statement of cash flows for the year?

A) Option A

B) Option B

C) Option C

D) Option D

E) Option E

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Duncan Inc. owned all of the outstanding

Q44: Where do dividends paid to the noncontrolling

Q57: During 2021, Parent Corporation purchased at carrying

Q82: MacDonald, Inc. owns 80% of the outstanding

Q98: How are intra-entity inventory transfers treated on

Q102: Ryan Company purchased 80% of Chase Company

Q104: Knight Co. owned 80% of the common

Q109: Panton, Inc. acquired 18,000 shares of Glotfelty

Q116: How does the creation of a consolidated

Q118: Which of the following statements regarding consolidation