Essay

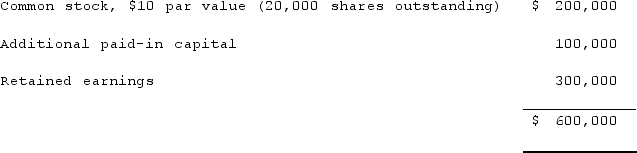

Panton, Inc. acquired 18,000 shares of Glotfelty Corp. several years ago for $30 per share when Glotfelty had a book value of $450,000. Before and after that time, Glotfelty's stock traded at $30 per share. At the present time, Glotfelty reports the following stockholders' equity:

Glotfelty issues 5,000 shares of previously unissued stock to the public for $40 per share. None of this stock is purchased by Panton.Describe how this transaction would affect Panton's books.

Glotfelty issues 5,000 shares of previously unissued stock to the public for $40 per share. None of this stock is purchased by Panton.Describe how this transaction would affect Panton's books.

Correct Answer:

Verified

The investment accou...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q12: Duncan Inc. owned all of the outstanding

Q22: Which of the following statements are true

Q44: Where do dividends paid to the noncontrolling

Q50: Webb Company purchased 90% of Jones Company

Q57: During 2021, Parent Corporation purchased at carrying

Q98: How are intra-entity inventory transfers treated on

Q105: Dayton, Inc. owns 80% of Haber Corp.

Q112: The accounting problems encountered in consolidated intra-entity

Q115: Ryan Company purchased 80% of Chase Company

Q118: Which of the following statements regarding consolidation