Multiple Choice

Palmer Corp. owned 80% of the outstanding common stock of Creed Inc. On January 1, 2019, Palmer acquired a building with a ten-year life for $450,000. No salvage value was anticipated and the building was to be depreciated on the straight-line basis. On January 1, 2021, Palmer sold this building to Creed for $412,000. At that time, the building had a remaining life of eight years but still no expected salvage value. For consolidation purposes, what is the Excess Depreciation (ED entry) for this building for 2021?

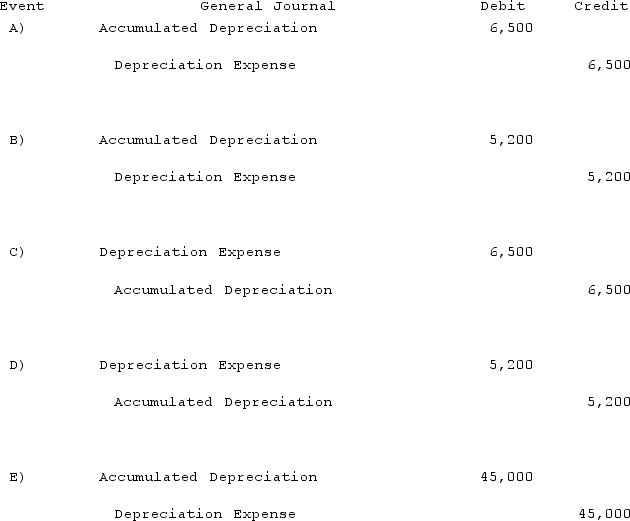

A) Option A.

B) Option B.

C) Option C.

D) Option D.

E) Option E.

Correct Answer:

Verified

Correct Answer:

Verified

Q44: On January 1, 2021, Pride, Inc. acquired

Q50: Wilson owned equipment with an estimated life

Q51: Walsh Company sells inventory to its subsidiary,

Q52: Wilson owned equipment with an estimated life

Q53: Anderson Company, a 90% owned subsidiary of

Q54: On January 1, 2021, Pride, Inc. acquired

Q56: Virginia Corp. owned all of the voting

Q82: Pot Co. holds 90% of the common

Q94: What is the impact on the noncontrolling

Q97: Strickland Company sells inventory to its parent,