Multiple Choice

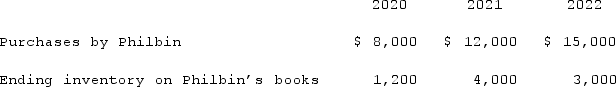

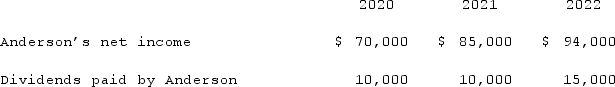

Anderson Company, a 90% owned subsidiary of Philbin Corporation, transfers inventory to Philbin at a 25% gross profit rate. The following data are available pertaining specifically to Philbin's intra-entity purchases from Anderson. Anderson was acquired on January 1, 2020.  Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends.

Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends. Assuming there are no excess amortizations associated with the consolidation, and no other intra-entity asset transfers, compute the net income attributable to the noncontrolling interest of Anderson for 2021.

Assuming there are no excess amortizations associated with the consolidation, and no other intra-entity asset transfers, compute the net income attributable to the noncontrolling interest of Anderson for 2021.

A) $8,500.

B) $8,570.

C) $8,430.

D) $8,400.

E) $7,580.

Correct Answer:

Verified

Correct Answer:

Verified

Q20: On April 7, 2021, Martinez Corp. sold

Q49: Palmer Corp. owned 80% of the outstanding

Q50: Wilson owned equipment with an estimated life

Q52: Wilson owned equipment with an estimated life

Q54: On January 1, 2021, Pride, Inc. acquired

Q55: Anderson Company, a 90% owned subsidiary of

Q56: Virginia Corp. owned all of the voting

Q58: On January 1, 2021, Pride, Inc. acquired

Q74: Milton Co. owned all of the voting

Q94: What is the impact on the noncontrolling