Multiple Choice

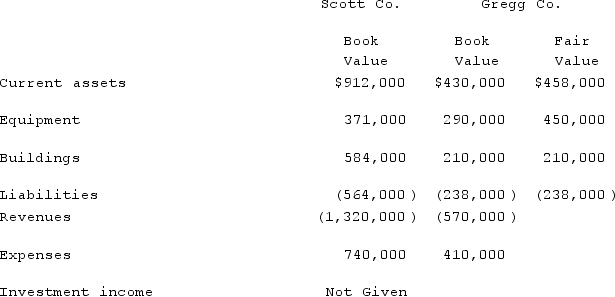

Scott Co. acquired 70% of Gregg Co. for $525,000 on December 31, 2019 when Gregg's book value was $580,000. The Gregg stock was not actively traded. On the date of acquisition, Gregg had equipment (with a ten-year life) that was undervalued in the financial records by $170,000. One year later, the two companies provided the selected amounts shown below. Additionally, no dividends have been paid.  What amount of consolidated net income for 2020 is attributable to Scott's controlling interest?

What amount of consolidated net income for 2020 is attributable to Scott's controlling interest?

A) $580,000.

B) $668,200.

C) $680,100.

D) $692,000.

E) $723,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q33: When a parent company acquires a less-than-100

Q45: How would you determine the amount of

Q93: When Valley Co. acquired 80% of the

Q111: McGuire Company acquired 90 percent of Hogan

Q112: On January 1, 2019, Palk Corp. and

Q113: McGuire Company acquired 90 percent of Hogan

Q115: Pell Company acquires 80% of Demers Company

Q117: Dodd Co. acquired 75% of the common

Q120: McGuire Company acquired 90 percent of Hogan

Q122: On January 1, 2019, Jannison Inc. acquired