Multiple Choice

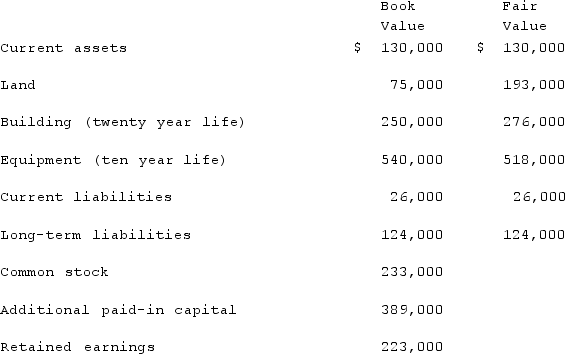

On January 1, 2020, Barber Corp. paid $1,160,000 to acquire Thompson Co. Thompson maintained separate incorporation. Barber used the equity method to account for the investment. The following information is available for Thompson's assets, liabilities, and stockholders' equity accounts on January 1, 2020:  Thompson earned net income for 2020 of $134,000 and paid dividends of $51,000 during the year.The 2020 total excess amortization of fair-value allocations is calculated to be

Thompson earned net income for 2020 of $134,000 and paid dividends of $51,000 during the year.The 2020 total excess amortization of fair-value allocations is calculated to be

A) ($2,200) .

B) ($900) .

C) $(1,300) .

D) $(2,100) .

E) $3,500.

Correct Answer:

Verified

Correct Answer:

Verified

Q44: Vaughn Inc. acquired all of the outstanding

Q47: Yules Co. acquired Noel Co. and applied

Q51: According to GAAP regarding amortization of goodwill,

Q67: Following are selected accounts for Green Corporation

Q72: Kaye Company acquired 100% of Fiore Company

Q74: Harrison, Inc. acquires 100% of the voting

Q75: An impairment model is used<br>A) To assess

Q77: Paperless Co. acquired Sheetless Co. and in

Q96: Under the initial value method, the parent

Q112: Vaughn Inc. acquired all of the outstanding