Multiple Choice

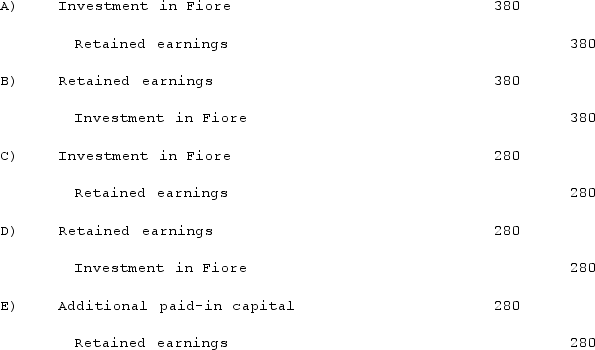

Kaye Company acquired 100% of Fiore Company on January 1, 2021. Kaye paid $1,000 excess consideration over book value, which is being amortized at $20 per year. There was no goodwill in the combination. Fiore reported net income of $400 in 2021 and paid dividends of $100.Assume the initial value method is used. In the year subsequent to acquisition, what additional worksheet entry must be made for consolidation purposes that is not required for the equity method?

A) Entry A.

B) Entry B.

C) Entry C.

D) Entry D.

E) Entry E.

Correct Answer:

Verified

Correct Answer:

Verified

Q44: Vaughn Inc. acquired all of the outstanding

Q47: Yules Co. acquired Noel Co. and applied

Q67: Following are selected accounts for Green Corporation

Q69: On January 1, 2020, Barber Corp. paid

Q73: Which of the following will result in

Q75: An impairment model is used<br>A) To assess

Q76: Following are selected accounts for Green Corporation

Q77: Paperless Co. acquired Sheetless Co. and in

Q77: When a company applies the partial equity

Q96: Under the initial value method, the parent