Multiple Choice

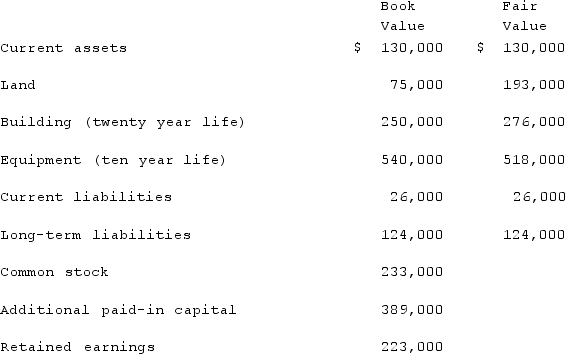

On January 1, 2020, Barber Corp. paid $1,160,000 to acquire Thompson Co. Thompson maintained separate incorporation. Barber used the equity method to account for the investment. The following information is available for Thompson's assets, liabilities, and stockholders' equity accounts on January 1, 2020:  Thompson earned net income for 2020 of $134,000 and paid dividends of $51,000 during the year.At the end of 2020, the consolidation entry to eliminate Barber's accrual of Thompson's earnings would include a credit to Investment in Thompson Co. for

Thompson earned net income for 2020 of $134,000 and paid dividends of $51,000 during the year.At the end of 2020, the consolidation entry to eliminate Barber's accrual of Thompson's earnings would include a credit to Investment in Thompson Co. for

A) $83,000.

B) $133,100.

C) $134,000.

D) $134,900.

E) $0.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Which of the following is not an

Q16: Scott Co. paid $2,800,000 to acquire all

Q29: On 1/1/19, Sey Mold Corporation acquired 100%

Q60: How does the parent's choice of investment

Q69: With respect to identifiable intangible assets other

Q71: Under the partial equity method, the parent

Q100: Watkins, Inc. acquires all of the outstanding

Q102: Following are selected accounts for Green Corporation

Q105: Jackson Company acquires 100% of the stock

Q115: Harrison, Inc. acquires 100% of the voting