Multiple Choice

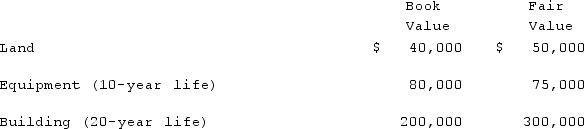

Watkins, Inc. acquires all of the outstanding stock of Glen Corporation on January 1, 2020. At that date, Glen owns only three assets and has no liabilities:  If Watkins pays $450,000 in cash for Glen, what amount would be represented as the subsidiary's Equipment in a consolidation at December 31, 2022, assuming the book value of the equipment at that date is still $80,000?

If Watkins pays $450,000 in cash for Glen, what amount would be represented as the subsidiary's Equipment in a consolidation at December 31, 2022, assuming the book value of the equipment at that date is still $80,000?

A) $70,000.

B) $73,500.

C) $75,000.

D) $76,500.

E) $80,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Which of the following is not an

Q16: Scott Co. paid $2,800,000 to acquire all

Q29: On 1/1/19, Sey Mold Corporation acquired 100%

Q60: How does the parent's choice of investment

Q69: With respect to identifiable intangible assets other

Q95: Watkins, Inc. acquires all of the outstanding

Q101: On January 1, 2020, Barber Corp. paid

Q102: Following are selected accounts for Green Corporation

Q105: Jackson Company acquires 100% of the stock

Q115: Harrison, Inc. acquires 100% of the voting