Multiple Choice

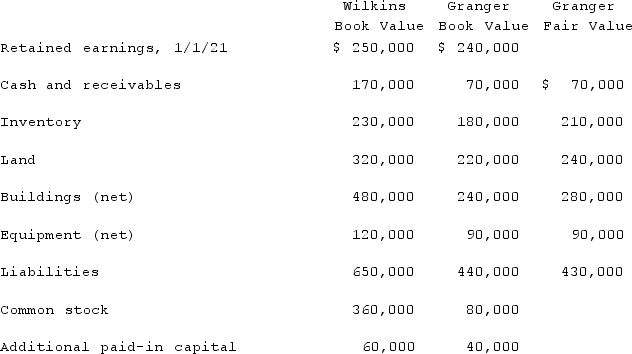

Wilkins Inc. acquired 100% of the voting common stock of Granger Inc. on January 1, 2021. The book value and fair value of Granger's accounts on that date (prior to creating the combination) are as follows, along with the book value of Wilkins's accounts:  Assume that Wilkins paid a total of $500,000 in cash for all of the shares of Granger. In addition, Wilkins paid $42,000 for secretarial and management time allocated to the acquisition transaction. What will be the balance in consolidated goodwill?

Assume that Wilkins paid a total of $500,000 in cash for all of the shares of Granger. In addition, Wilkins paid $42,000 for secretarial and management time allocated to the acquisition transaction. What will be the balance in consolidated goodwill?

A) $0.

B) $20,000.

C) $40,000.

D) $42,000.

E) $82,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: How are direct combination costs, contingent consideration,

Q35: What is the purpose of Consolidation Entry

Q47: Which of the following statements is true

Q85: The financial statements for Campbell, Inc., and

Q86: How should direct combination costs and amounts

Q87: Presented below are the financial balances for

Q92: On January 1, 2021, the Moody Company

Q93: Wilkins Inc. acquired 100% of the voting

Q94: Wilkins Inc. acquired 100% of the voting

Q95: For each of the following situations, select