Multiple Choice

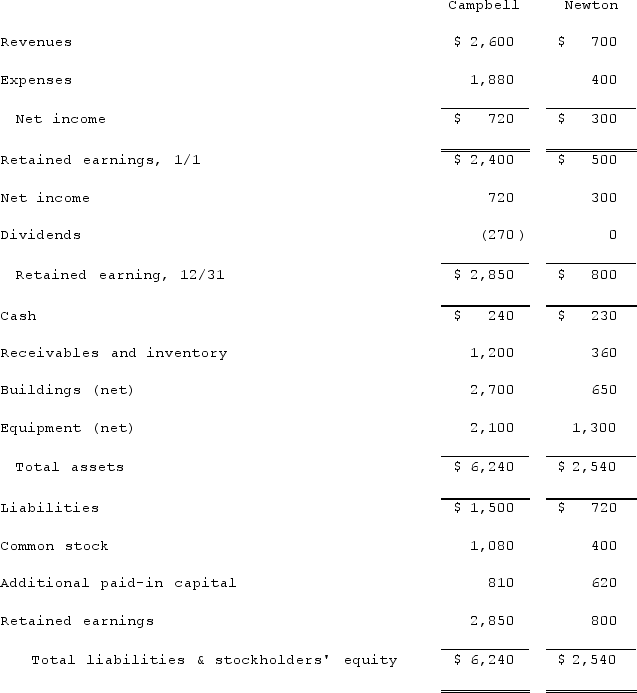

The financial statements for Campbell, Inc., and Newton Company for the year ended December 31, 2021, prior to the business combination whereby Campbell acquired Newton, are as follows (in thousands) :  On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35 shares of its $10 par value common stock, in exchange for all of Newton's common stock. At the time of the transaction, Campbell's common stock had a fair value of $40 per share.In connection with the business combination, Campbell paid $25 to a broker for arranging the transaction and $30 in stock issuance costs. At the time of the transaction, Newton's equipment was actually worth $1,450 but its buildings were only valued at $590.What total amount of additional paid-in capital will Campbell recognize from this acquisition?

On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35 shares of its $10 par value common stock, in exchange for all of Newton's common stock. At the time of the transaction, Campbell's common stock had a fair value of $40 per share.In connection with the business combination, Campbell paid $25 to a broker for arranging the transaction and $30 in stock issuance costs. At the time of the transaction, Newton's equipment was actually worth $1,450 but its buildings were only valued at $590.What total amount of additional paid-in capital will Campbell recognize from this acquisition?

A) $1,020.

B) $1,050.

C) $1,080.

D) $1,105.

E) $1,400.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: How are direct combination costs, contingent consideration,

Q21: How are bargain purchases accounted for in

Q35: What is the purpose of Consolidation Entry

Q56: With respect to recognizing and measuring the

Q78: What is the primary difference between recording

Q80: On January 1, 2021, the Moody Company

Q86: How should direct combination costs and amounts

Q87: Presented below are the financial balances for

Q90: Wilkins Inc. acquired 100% of the voting

Q111: For acquisition accounting, why are assets and