Multiple Choice

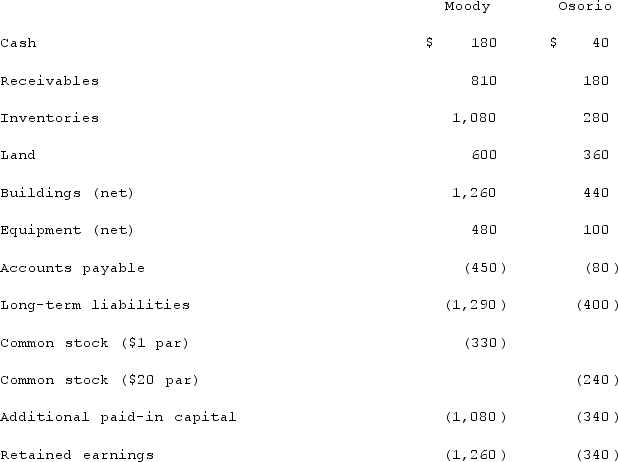

On January 1, 2021, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and also issued 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.What is the amount of goodwill arising from this acquisition?

Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.What is the amount of goodwill arising from this acquisition?

A) $230.

B) $120.

C) $520.

D) None. There is a gain on bargain purchase of $230.

E) None. There is a gain on bargain purchase of $265.

Correct Answer:

Verified

Correct Answer:

Verified

Q48: The financial statement amounts for the Atwood

Q50: Flynn acquires 100 percent of the outstanding

Q51: The financial statement amounts for the Atwood

Q52: McCoy has the following account balances as

Q54: Presented below are the financial balances for

Q55: Flynn acquires 100 percent of the outstanding

Q56: The financial statements for Campbell, Inc., and

Q57: Salem Co. had the following account balances

Q58: Flynn acquires 100 percent of the outstanding

Q108: Acquired in-process research and development is considered