Multiple Choice

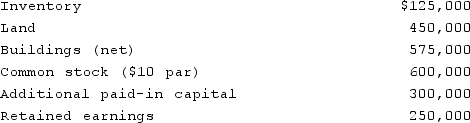

McCoy has the following account balances as of December 31, 2020 before an acquisition transaction takes place.  The fair value of McCoy's Land and Buildings are $650,000 and $600,000, respectively. On December 31, 2020, Ferguson Company issues 30,000 shares of its $10 par value ($30 fair value) common stock in exchange for all of the shares of McCoy's common stock. Ferguson paid $12,000 for costs to issue the new shares of stock. Before the acquisition, Ferguson has $800,000 in its common stock account and $350,000 in its additional paid-in capital account.What will be the consolidated additional paid-in capital as a result of this acquisition?

The fair value of McCoy's Land and Buildings are $650,000 and $600,000, respectively. On December 31, 2020, Ferguson Company issues 30,000 shares of its $10 par value ($30 fair value) common stock in exchange for all of the shares of McCoy's common stock. Ferguson paid $12,000 for costs to issue the new shares of stock. Before the acquisition, Ferguson has $800,000 in its common stock account and $350,000 in its additional paid-in capital account.What will be the consolidated additional paid-in capital as a result of this acquisition?

A) $350,000.

B) $650,000.

C) $938,000.

D) $950,000.

E) $962,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q47: On January 1, 2021, the Moody Company

Q48: The financial statement amounts for the Atwood

Q50: Flynn acquires 100 percent of the outstanding

Q51: The financial statement amounts for the Atwood

Q53: On January 1, 2021, the Moody Company

Q54: Presented below are the financial balances for

Q55: Flynn acquires 100 percent of the outstanding

Q56: The financial statements for Campbell, Inc., and

Q57: Salem Co. had the following account balances

Q108: Acquired in-process research and development is considered