Essay

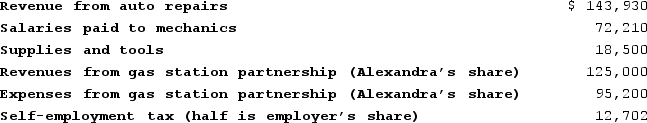

Alexandra operates a garage as a sole proprietorship. Alexandra also owns a half interest in a partnership that operates a gas station. This year Alexandra paid or reported the following expenses related to her garage and other property. Determine Alexandra's AGI for 2020.

Correct Answer:

Verified

$76,669

All of the expenses ar...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

All of the expenses ar...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: Chuck has AGI of $70,000 and has

Q7: Self-employed taxpayers can deduct the cost of

Q8: Excess business lossesin 2020 are carried back

Q9: Which of the following is a true

Q10: This year, Jong paid $3,000 of interest

Q12: Which of the following is a true

Q13: Andres and Lakeisha are married and file

Q14: Rachel is an engineer who practices as

Q15: All investment expenses are itemized deductions.

Q16: The medical expense deduction is designed to