Essay

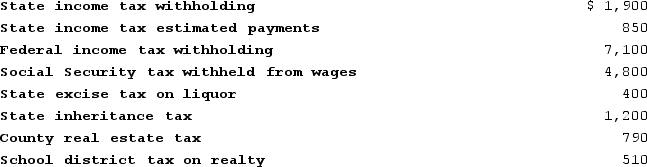

Chuck has AGI of $70,000 and has made the following payments:

Calculate the amount of taxes that Chuck can include with his itemized deductions.

Calculate the amount of taxes that Chuck can include with his itemized deductions.

Correct Answer:

Verified

$4,050 = $1,900 + $850 + $790 ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

$4,050 = $1,900 + $850 + $790 ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q1: Kaylee is a self-employed investment counselor who

Q2: This year Kelly bought a new auto

Q3: Max, a single taxpayer, has a $270,000

Q4: The deduction to individual taxpayers for charitable

Q5: Margaret Lindley paid $15,030 of interest on

Q7: Self-employed taxpayers can deduct the cost of

Q8: Excess business lossesin 2020 are carried back

Q9: Which of the following is a true

Q10: This year, Jong paid $3,000 of interest

Q11: Alexandra operates a garage as a sole