Essay

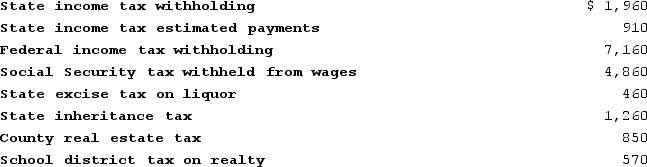

Chuck has AGI of $70,600 and has made the following payments:

Calculate the amount of taxes that Chuck can include with his itemized deductions.

Calculate the amount of taxes that Chuck can include with his itemized deductions.

Correct Answer:

Verified

${{[a(10)]:#,###}} = ${{[a(2)]:#,###}} +...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

${{[a(10)]:#,###}} = ${{[a(2)]:#,###}} +...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q22: This year Amanda paid $749 in federal

Q23: Glenn is an accountant who races stock

Q24: Mason paid $4,100 of interest on a

Q25: The deduction for medical expenses is limited

Q26: Tita, a married taxpayer filing jointly, has

Q28: To be deductible, business expenses must be

Q29: Which of the following is a true

Q30: In 2020, Latrell made the following charitable

Q31: Taxpayers generally deduct the lesser of their

Q32: Which of the following is a true