Essay

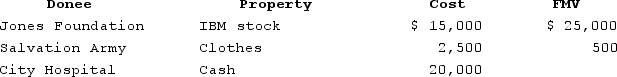

In 2020, Latrell made the following charitable contributions:

Determine the maximum amount of Latrell's charitable deduction assuming the Jones Foundation is a private nonoperating foundation and Latrell's AGI is $100,000 this year. You may assume that the stock and painting have been owned for 10 years.

Determine the maximum amount of Latrell's charitable deduction assuming the Jones Foundation is a private nonoperating foundation and Latrell's AGI is $100,000 this year. You may assume that the stock and painting have been owned for 10 years.

Correct Answer:

Verified

The charitable deduction is $40,500 over...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q25: The deduction for medical expenses is limited

Q26: Tita, a married taxpayer filing jointly, has

Q27: Chuck has AGI of $70,600 and has

Q28: To be deductible, business expenses must be

Q29: Which of the following is a true

Q31: Taxpayers generally deduct the lesser of their

Q32: Which of the following is a true

Q33: Which of the following is a true

Q34: This year Darcy made the following charitable

Q35: Ned is a head of household with