Essay

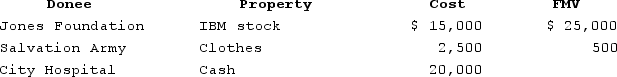

This year Latrell made the following charitable contributions:

Determine the maximum amount of Latrell's charitable deduction assuming the Jones Foundation is a private nonoperating foundation and Latrell's AGI is $100,000 this year. You may assume that the stock and painting have been owned for 10 years.

Determine the maximum amount of Latrell's charitable deduction assuming the Jones Foundation is a private nonoperating foundation and Latrell's AGI is $100,000 this year. You may assume that the stock and painting have been owned for 10 years.

Correct Answer:

Verified

The charitable deduction is $40,500 over...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q55: To qualify as a charitable deduction, the

Q56: Misti purchased a residence this year. Misti,

Q57: This year, Benjamin Hassell paid $20,000 of

Q58: In 2020, Darcy made the following charitable

Q59: Which of the following costs are deductible

Q61: An individual who is eligible to be

Q62: Which of the following is a true

Q63: Misti purchased a residence this year. Misti,

Q64: In 2020, the deduction to individual taxpayers

Q65: Bunching itemized deductions is one form of