Essay

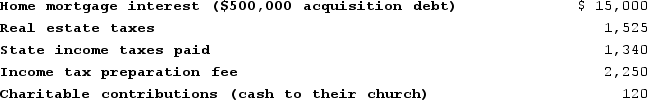

Misti purchased a residence this year. Misti, age 32, is a single parent and lives with her 1-year-old daughter. In 2020, Misti received a salary of $160,000 and made the following payments:

Misti files as a head of household. Calculate her taxable income this year.

Misti files as a head of household. Calculate her taxable income this year.

Correct Answer:

Verified

$141,230 = $160,000 salary − $120 for AG...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q51: Generally, service businesses are considered qualified trade

Q52: In general, taxpayers are allowed to deduct

Q53: Rachel is an accountant who practices as

Q54: Qualified education expenses for purposes of the

Q55: To qualify as a charitable deduction, the

Q57: This year, Benjamin Hassell paid $20,000 of

Q58: In 2020, Darcy made the following charitable

Q59: Which of the following costs are deductible

Q60: This year Latrell made the following charitable

Q61: An individual who is eligible to be