Essay

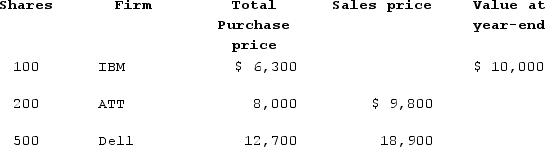

This year Ann has the following stock transactions. What amount is included in her gross income if Ann paid a $285 selling commission for each sale?

Correct Answer:

Verified

${{[a(14)]:#,###}}. ATT: (${{[a(8)]:#,##...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

${{[a(14)]:#,###}}. ATT: (${{[a(8)]:#,##...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q30: This year Henry realized a gain on

Q31: Lisa and Collin are married. Lisa works

Q32: Pam recently was sickened by eating spoiled

Q33: To calculate a gain or loss on

Q34: Cyrus is a cash method taxpayer who

Q36: Identify the rule that determines whether a

Q37: The assignment of income doctrine requires that

Q38: Andres has received the following benefits this

Q39: Frank received the following benefits from his

Q40: Fran purchased an annuity that provides $12,000