Essay

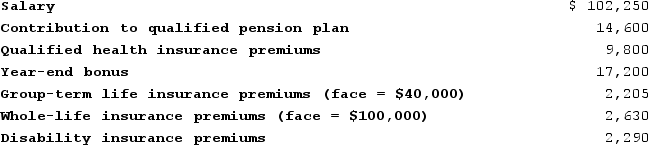

Andres has received the following benefits this year.

Besides these benefits Andres missed work for two months due to an illness. During his illness Andres received $7,810 in sick pay from a disability insurance policy. Assume Andres has disability insurance provided by his employer as a nontaxable fringe benefit. What amount, if any, must Andres include in gross income this year?

Besides these benefits Andres missed work for two months due to an illness. During his illness Andres received $7,810 in sick pay from a disability insurance policy. Assume Andres has disability insurance provided by his employer as a nontaxable fringe benefit. What amount, if any, must Andres include in gross income this year?

Correct Answer:

Verified

${{[a(11)]:#,###}} = ${{[a(1)]:#,###}} +...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q33: To calculate a gain or loss on

Q34: Cyrus is a cash method taxpayer who

Q35: This year Ann has the following stock

Q36: Identify the rule that determines whether a

Q37: The assignment of income doctrine requires that

Q39: Frank received the following benefits from his

Q40: Fran purchased an annuity that provides $12,000

Q41: U.S. citizens generally are subject to tax

Q42: Brenda has $15,000 in U.S. Series EE

Q43: The cash method of accounting requires taxpayers