Multiple Choice

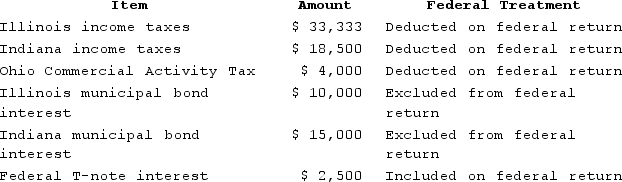

PWD Incorporated is an Illinois corporation. It properly included, deducted, or excluded the following items on its federal tax return in the current year:  PWD's federal taxable income was $100,000. If Illinois only requires Illinois taxes to be added back, calculate PWD's Illinois state tax base.

PWD's federal taxable income was $100,000. If Illinois only requires Illinois taxes to be added back, calculate PWD's Illinois state tax base.

A) $116,000

B) $130,833

C) $131,000

D) $145,833

Correct Answer:

Verified

Correct Answer:

Verified

Q67: Public Law 86-272 protects only companies selling

Q68: Hoosier Incorporated is an Indiana corporation. It

Q69: Which of the following statements regarding income

Q70: All of the following are false regarding

Q71: Wacky Wendy produces gourmet cheese in Wisconsin.

Q73: Super Sadie, Incorporated, manufactures sandals and distributes

Q74: Gordon operates the Tennis Pro Shop in

Q75: Public Law 86-272 was a congressional response

Q76: Wyoming imposes an income tax on corporations.

Q77: Super Sadie, Incorporated, manufactures sandals and distributes