Multiple Choice

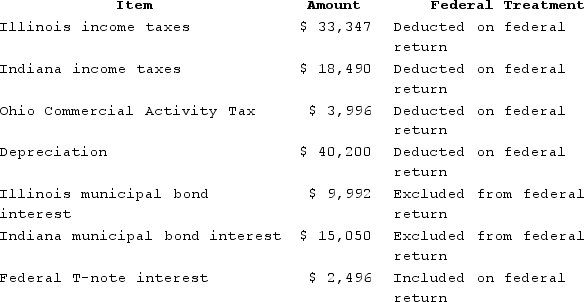

Hoosier Incorporated is an Indiana corporation. It properly included, deducted, or excluded the following items on its federal tax return in the current year:  State depreciation expense was $50,200. Hoosier's federal taxable income was $150,500. Calculate Hoosier's Indiana state tax base.

State depreciation expense was $50,200. Hoosier's federal taxable income was $150,500. Calculate Hoosier's Indiana state tax base.

A) $171,486

B) $173,982

C) $199,833

D) $207,333

Correct Answer:

Verified

Correct Answer:

Verified

Q63: Tennis Pro has the following sales, payroll,

Q64: Which of the following is not a

Q65: Tennis Pro has the following sales, payroll,

Q66: Della Corporation is headquartered in Carlisle, Pennsylvania.

Q67: Public Law 86-272 protects only companies selling

Q69: Which of the following statements regarding income

Q70: All of the following are false regarding

Q71: Wacky Wendy produces gourmet cheese in Wisconsin.

Q72: PWD Incorporated is an Illinois corporation. It

Q73: Super Sadie, Incorporated, manufactures sandals and distributes