Multiple Choice

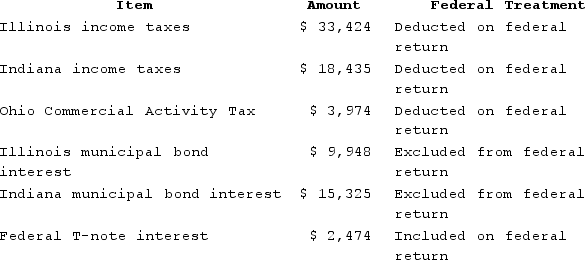

PWD Incorporated is an Illinois corporation. It properly included, deducted, or excluded the following items on its federal tax return in the current year:  PWD's federal taxable income was $113,000. If Illinois only requires Illinois taxes to be added back, calculate PWD's Illinois state tax base.

PWD's federal taxable income was $113,000. If Illinois only requires Illinois taxes to be added back, calculate PWD's Illinois state tax base.

A) $128,961

B) $143,411

C) $144,286

D) $159,275

Correct Answer:

Verified

Correct Answer:

Verified

Q120: Businesses engaged in interstate commerce are subject

Q121: Which of the following is incorrect regarding

Q122: Roxy operates a dress shop in Arlington,

Q123: Super Sadie, Incorporated, manufactures sandals and distributes

Q124: Tennis Pro is headquartered in Virginia. Assume

Q126: Lefty provides demolition services in several southern

Q127: Carolina's Hats has the following sales, payroll,

Q128: In Complete Auto Transit the U.S. Supreme

Q129: Mahre, Incorporated, a New York corporation, runs

Q130: Mighty Manny, Incorporated manufactures and services deli