Essay

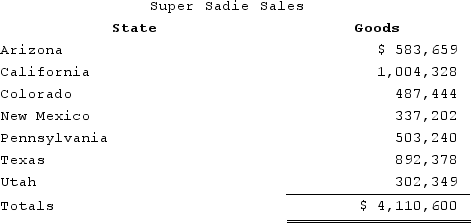

Super Sadie, Incorporated, manufactures sandals and distributes them across the southwestern United States. Assume that Super Sadie has sales tax nexus in Arizona, California, Colorado, New Mexico, and Texas. Super Sadie has sales as follows:

Assume the following sales tax rates: Arizona (6 percent), California (8 percent), Colorado (7 percent), New Mexico (6.5 percent), Pennsylvania (7.25 percent), Texas (8 percent), and Utah (5 percent). What is Super Sadie's total sales and use tax liability? (Round your interim calculations to the nearest whole number.)

Assume the following sales tax rates: Arizona (6 percent), California (8 percent), Colorado (7 percent), New Mexico (6.5 percent), Pennsylvania (7.25 percent), Texas (8 percent), and Utah (5 percent). What is Super Sadie's total sales and use tax liability? (Round your interim calculations to the nearest whole number.)

Correct Answer:

Verified

${{[a(23)]:#,###}}.

(${{[a(1)]...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

(${{[a(1)]...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q118: Giving samples and promotional materials without charge

Q119: A state's apportionment formula usually is applied

Q120: Businesses engaged in interstate commerce are subject

Q121: Which of the following is incorrect regarding

Q122: Roxy operates a dress shop in Arlington,

Q124: Tennis Pro is headquartered in Virginia. Assume

Q125: PWD Incorporated is an Illinois corporation. It

Q126: Lefty provides demolition services in several southern

Q127: Carolina's Hats has the following sales, payroll,

Q128: In Complete Auto Transit the U.S. Supreme