Essay

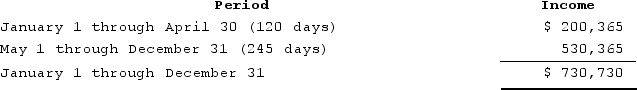

ABC was formed as a calendar-year S corporation with Alan, Brenda, and Conner as equal shareholders. On May 1, 2020, ABC's S election was terminated after Conner sold his ABC shares (one-third of all shares)to his solely owned C corporation, Conner, Incorporated ABC reported business income for 2020 as follows: (Assume that there are 365 days in the year.)

If ABC uses the daily method of allocating income between the S corporation short tax year (January 1-April 30)and the C corporation short tax year (May 1-December 31), how much income will it report on its S corporation short tax year return and its C corporation short tax year return for 2020?

If ABC uses the daily method of allocating income between the S corporation short tax year (January 1-April 30)and the C corporation short tax year (May 1-December 31), how much income will it report on its S corporation short tax year return and its C corporation short tax year return for 2020?

Correct Answer:

Verified

S corporation short tax year = ${{[a(7)]...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q27: Clampett, Incorporated, has been an S corporation

Q28: Assume that Clampett, Incorporated, has $200,000 of

Q29: Which of the following is not a

Q30: Which of the following statements is correct?<br>A)The

Q31: RGD Corporation was a C corporation from

Q33: When an S corporation distributes appreciated property

Q34: Clampett, Incorporated, has been an S corporation

Q35: At the beginning of the year, Clampett,

Q36: After terminating or voluntarily revoking S corporation

Q37: RGD Corporation was a C corporation from