Essay

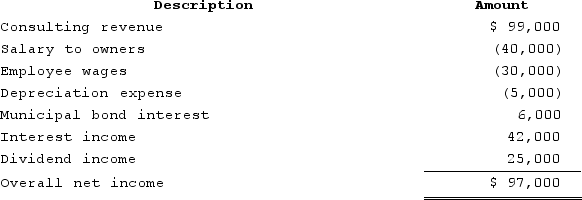

RGD Corporation was a C corporation from its inception in 2015 through 2019. However, it elected S corporation status effective January 1, 2020. RGD had $50,000 of earnings and profits at the end of 2019. RGD reported the following information for its 2020 tax year.

What amount of excess net passive income tax is RGD liable for in 2020? Assume the corporate tax rate is 21%.

What amount of excess net passive income tax is RGD liable for in 2020? Assume the corporate tax rate is 21%.

Correct Answer:

Verified

$6,300 (21% × $30,000). Passive investme...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q26: S corporations without earnings and profits from

Q27: Clampett, Incorporated, has been an S corporation

Q28: Assume that Clampett, Incorporated, has $200,000 of

Q29: Which of the following is not a

Q30: Which of the following statements is correct?<br>A)The

Q32: ABC was formed as a calendar-year S

Q33: When an S corporation distributes appreciated property

Q34: Clampett, Incorporated, has been an S corporation

Q35: At the beginning of the year, Clampett,

Q36: After terminating or voluntarily revoking S corporation