Lincoln, Incorporated, Washington, Incorporated, and Adams, Incorporated, Form Presidential Suites

Essay

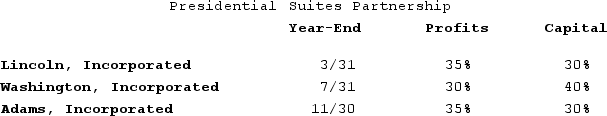

Lincoln, Incorporated, Washington, Incorporated, and Adams, Incorporated, form Presidential Suites Partnership on February 15, 20X9. Now, Presidential Suites must adopt its required tax year-end. The partners' year-ends, profits interests, and capital interests are reflected in the table below. Given this information, what tax year-end must Presidential Suites use, and what rule requires this year-end?

Correct Answer:

Verified

Because the partners all have different ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q51: Alfred, a one-third profits and capital partner

Q52: Styling Shoes, LLC, filed its 20X8 Form

Q53: A general partner's share of ordinary business

Q54: In X1, Adam and Jason formed ABC,

Q55: Erica and Brett decide to form their

Q57: Actual or deemed cash distributions in excess

Q58: On 12/31/X4, Zoom, LLC, reported a $60,000

Q59: KBL, Incorporated, AGW, Incorporated, Blaster, Incorporated, Shiny

Q60: Nonrecourse debt is generally allocated according to

Q61: XYZ, LLC, has several individual and corporate