Essay

Alfred, a one-third profits and capital partner in Pizzeria Partnership, needs help in adjusting his tax basis to reflect the information contained in his most recent Schedule K-1 from the partnership. Unfortunately, the Schedule K-1 he recently received was for Year 3 of the partnership, but Alfred only knows that his tax basis at the beginning of Year 2 of the partnership was $23,000. Thankfully, Alfred still has his Schedule K-1 from the partnership for Years 1 and 2.

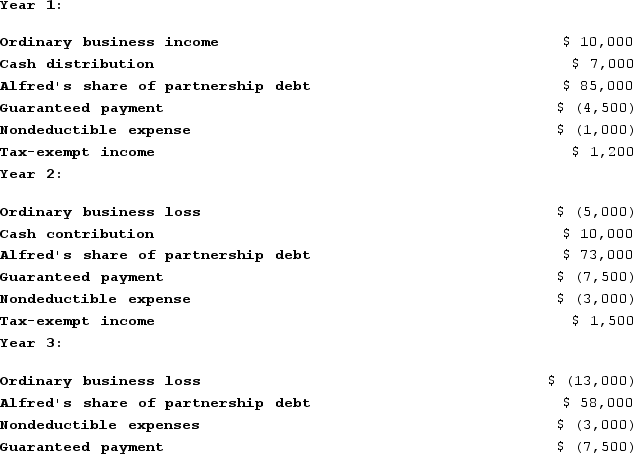

Using the following information from Alfred's Year 1, Year 2, and Year 3 Schedule K-1, calculate his tax basis the end of Year 2 and Year 3.

Correct Answer:

Verified

At the end of Year 2, Alfred's basis is ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q46: Hilary had an outside basis in LTL

Q47: What form does a partnership use when

Q49: On April 18, 20X8, Robert sold his

Q50: Hilary had an outside basis in LTL

Q52: Styling Shoes, LLC, filed its 20X8 Form

Q53: A general partner's share of ordinary business

Q54: In X1, Adam and Jason formed ABC,

Q55: Erica and Brett decide to form their

Q56: Lincoln, Incorporated, Washington, Incorporated, and Adams, Incorporated,

Q68: If a taxpayer sells a passive activity