Essay

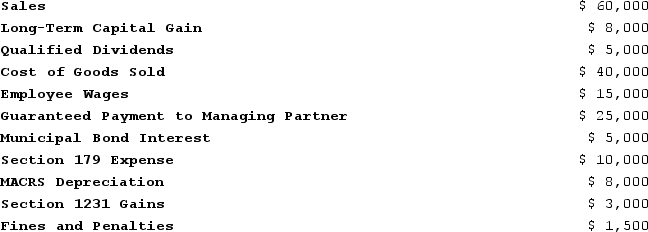

Illuminating Light Partnership had the following revenues, expenses, gains, losses, and distributions:

Given these items, what is Illuminating Light's ordinary business income (loss)for the year?

Given these items, what is Illuminating Light's ordinary business income (loss)for the year?

Correct Answer:

Verified

($28,000),...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q79: Lloyd and Harry, equal partners, form the

Q80: Ruby's tax basis in her partnership interest

Q81: John, a limited partner of Candy Apple,

Q82: Peter, Matt, Priscilla, and Mary began the

Q83: Jerry, a partner with 30percent capital and

Q85: A partner's self-employment earnings (loss)may be affected

Q86: Which of the following items will affect

Q87: What general accounting methods may be used

Q88: Partnerships can use special allocations to shift

Q89: What is the correct order for applying