Essay

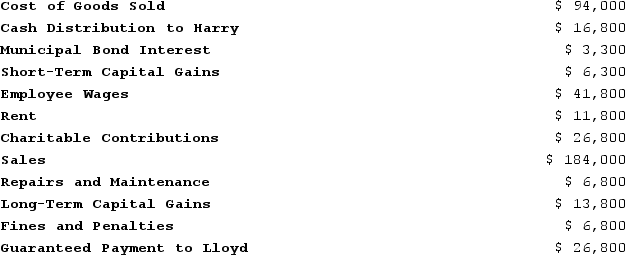

Lloyd and Harry, equal partners, form the Ant World Partnership. During the year, Ant World had the following revenue, expenses, gains, losses, and distributions:

Given these items, what amount of ordinary business income (loss)and what separately stated items should be allocated to each partner for the year?

Given these items, what amount of ordinary business income (loss)and what separately stated items should be allocated to each partner for the year?

Correct Answer:

Verified

The amount of ordinary busines...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q74: On 12/31/X4, Zoom,LLC, reported a $54,000 loss

Q75: Gerald received a one-third capital and profit

Q76: On April 18, 20X8, Robert sold his

Q77: A partner's outside basis must first be

Q78: Under general circumstances, debt is allocated from

Q80: Ruby's tax basis in her partnership interest

Q81: John, a limited partner of Candy Apple,

Q82: Peter, Matt, Priscilla, and Mary began the

Q83: Jerry, a partner with 30percent capital and

Q84: Illuminating Light Partnership had the following revenues,