Essay

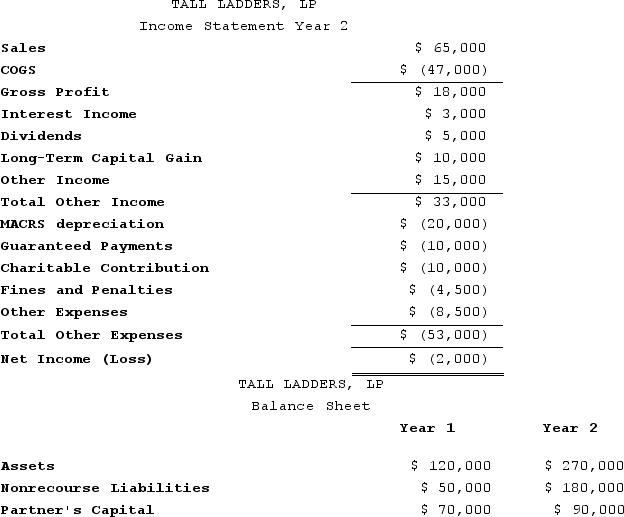

At the end of Year 1, Tony had a tax basis of $40,000 in Tall Ladders, Limited Partnership. Tony has a 20 percent profits interest in Tall Ladders. For Year 2, Tall Ladders will pay Tony a $10,000 guaranteed payment for extra services he provides to the partnership. Given the following income statement and balance sheet from Tall Ladders, what is Tony's adjusted tax basis at the end of Year 2?

Correct Answer:

Verified

Tony's adjusted basis at the end of Year...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q12: Clint noticed that the Schedule K-1 he

Q13: On March 15, 20X9, Troy, Peter, and

Q14: Ruby's tax basis in her partnership interest

Q15: Jay has a tax basis of $14,000

Q16: Ruby's tax basis in her partnership interest

Q18: Frank and Bob are equal members in

Q19: The term "outside basis" refers to the

Q20: Frank and Bob are equal members in

Q21: J&J, LLC, was in its third year

Q22: Ruby's tax basis in her partnership interest