Essay

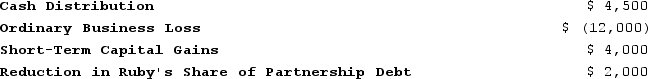

Ruby's tax basis in her partnership interest at the beginning of the partnership's tax year was $14,275. The following items were included in her Schedule K-1 from the partnership for the year:

Determine what amounts related to these items Ruby will report on her tax return assuming her tax basis and at-risk amount are equal and that she is a material participant in the partnership's activities. Further, assume that Ruby and her husband, Gerald, are not involved in any other trade or business and that they file a joint return every year.

Determine what amounts related to these items Ruby will report on her tax return assuming her tax basis and at-risk amount are equal and that she is a material participant in the partnership's activities. Further, assume that Ruby and her husband, Gerald, are not involved in any other trade or business and that they file a joint return every year.

Correct Answer:

Verified

As shown in the table below, Ruby must f...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: At the end of Year 1, Tony

Q18: Frank and Bob are equal members in

Q19: The term "outside basis" refers to the

Q20: Frank and Bob are equal members in

Q21: J&J, LLC, was in its third year

Q23: The main difference between a partner's tax

Q24: Greg, a 40percent partner in GSS Partnership,

Q25: Which of the following does not represent

Q26: Alfred, a one-third profits and capital partner

Q27: ER General Partnership, a medical supplies business,