Essay

Alfred, a one-third profits and capital partner in Pizzeria Partnership, needs help in adjusting his tax basis to reflect the information contained in his most recent Schedule K-1 from the partnership. Unfortunately, the Schedule K-1 he recently received was for Year 3 of the partnership, but Alfred only knows that his tax basis at the beginning of Year 2 of the partnership was $23,400. Thankfully, Alfred still has his Schedule K-1 from the partnership for Years 1 and 2.

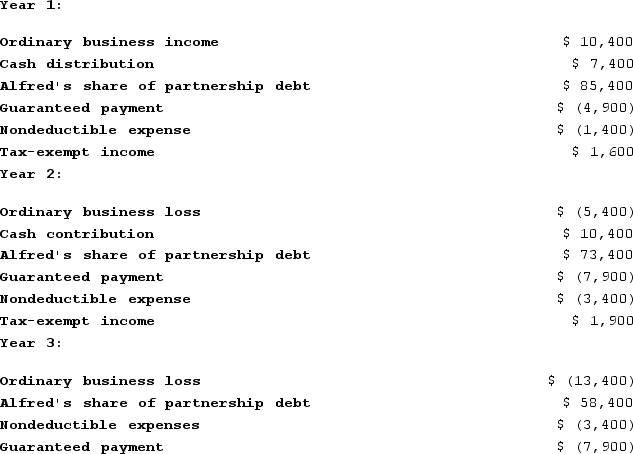

Using the following information from Alfred's Year 1, Year 2, and Year 3 Schedule K-1, calculate his tax basis the end of Year 2 and Year 3.

Correct Answer:

Verified

At the end of Year 2, Alfred's basis is ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q21: J&J, LLC, was in its third year

Q22: Ruby's tax basis in her partnership interest

Q23: The main difference between a partner's tax

Q24: Greg, a 40percent partner in GSS Partnership,

Q25: Which of the following does not represent

Q27: ER General Partnership, a medical supplies business,

Q28: Guaranteed payments are included in the calculation

Q29: The least aggregate deferral test uses the

Q30: On January 1, X9, Gerald received his

Q31: Partnerships may maintain their capital accounts according