Essay

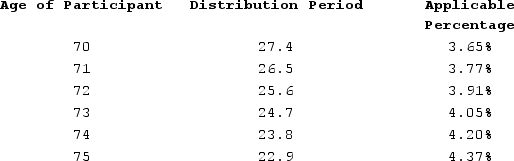

Sean (age 74 at end of 2020)retired five years ago. The balance in his 401(k)account on December 31, 2019, was $1,700,000 and the balance in his account on December 31, 2020, was $1,800,000. Using the Treasury tables below, what is Sean's required minimum distribution for 2020?

Correct Answer:

Verified

For 2020, his required minimum...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q76: Katrina's executive compensation package allows her to

Q77: Which of the following describes a defined

Q78: Tatia, age 38, has made deductible contributions

Q79: Christina made a one-time contribution of $16,000

Q80: Sean (age 74 at end of 2020)retired

Q82: This year, Ryan contributed 10 percent of

Q83: Yvette is a 44-year-old self-employed contractor (no

Q84: Which of the following statements comparing qualified

Q85: Amy is single. During 2020, she determined

Q86: Heidi retired from GE (her employer)at age