Essay

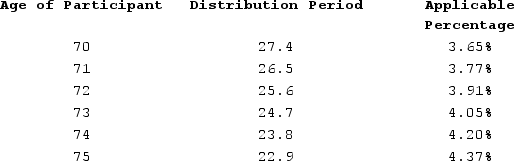

Sean (age 74 at end of 2020)retired five years ago. The balance in his 401(k)account on December 31, 2019, was $1,700,000 and the balance in his account on December 31, 2020, was $1,750,000. In 2020, Sean received a distribution of $50,000 from his 401(k)account. Assuming Sean's marginal tax rate is 25 percent, what amount of the $50,000 distribution will Sean have left after paying income tax on the distribution and paying any minimum distribution penalties (use the Treasury table below in determining therequired minimum distribution penalty, if any).

Correct Answer:

Verified

$26,800 remaining after taxes and penalt...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q75: Shauna received a $100,000 distribution from her

Q76: Katrina's executive compensation package allows her to

Q77: Which of the following describes a defined

Q78: Tatia, age 38, has made deductible contributions

Q79: Christina made a one-time contribution of $16,000

Q81: Sean (age 74 at end of 2020)retired

Q82: This year, Ryan contributed 10 percent of

Q83: Yvette is a 44-year-old self-employed contractor (no

Q84: Which of the following statements comparing qualified

Q85: Amy is single. During 2020, she determined